You have come to the correct spot if you are an online retailer seeking a good payment gateway software open source. There are now several vendors of the best payment gateway for international transactions. This article about trustworthy top 15 payment gateways in the USA can be beneficial if you want to ensure that you’re picking the right one. When we discuss payment gateways, the following queries spring to mind: A top payment gateway is what? What is the operation of a payment gateway provider? How is a payment gateway built? If you have ever purchased anything from an online retailer, you must have made your payment online. Also, the website should have given you different ways to pay, like GPay, MasterCard, etc.

A payment gateway software development company that offers online payment services. It lets you pay online or accept payments in different currencies from people in other countries. The best payment processing software in this category is reviewed in-depth in this article so you can choose the best option for your company’s needs. payment gateway integration is an important part of e-commerce because they act as a middleman between a customer’s credit card payment and the bank.

15 Best Payment Gateway Software in 2022

The best Payment Gateway Software ones send the private credit/debit card and bank account information of the customer to the issuing bank in a safe way and ask the bank to confirm whether the transaction was approved or not. The way e-commerce businesses take and handle payments has evolved as a result of technology. The most well-known of these are Payment Gateway Software, whose acceptance has been continuously increasing. It is only one of the payment trends that is believed to be altering how we pay, though.

#1. Melio

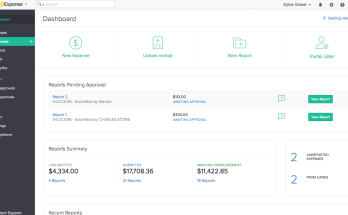

Payment Gateway Software Melio is a simple payment gateway that makes it easy for US-based small businesses to send and receive money for invoices. It’s a good solution that gets rid of the time-consuming ways of paying bills that slow down your cash flow and fill up your schedule. When used effectively, the app serves as the brain of the money-in-money-out operations. Melio allows you to pay all your bills with the money you withdraw, including those for utilities, rent, insurance, advertising, and payments to other companies for goods and services. It enables you to pay by bank transfer or credit card regardless of the payment method offered by the merchant, in order to make the payment procedure as simple as possible. What’s great is that you don’t have to go it alone.

You may establish roles and permissions for additional people in your organization using the payment approval workflows. By doing this, you can give other people jobs like setting up payments and approvals while still keeping track of your money. This is due to Melio’s real-time notification settings, which let you know as soon as a payment is planned or executed. Melio makes it simple to receive payments online for the money you put in. Simply generating a pay link and sharing it with the relevant customer is all that is required. The link allows the client to quickly and easily pay you with a credit card or bank transfer without having to register. The pay-link feature of Melio payment allows you to follow payments as they make their payment to your bank account, which is an additional advantage.

#2. BlueSnap

Payment Gateway Software An affiliate marketing and worldwide payment management system is called BlueSnap. This platform enables businesses to accept payments from both local and foreign customers. The best thing about this solution is the way it stops fraud, which leads to a big drop in fraudulent payments. In its Powered Buy Platform, BlueSnap provides a global network of purchasing banks. The benefit is that retailers can make more money by getting the best conversion rates for payments. Another crucial component is BlueSnap’s cutting-edge subscription billing system, which produces precise bills. Other important parts include payment APIs, hosted solutions, payment processors, merchant accounts, virtual terminals, and third-party plugins.

Payment Gateway Software An affiliate marketing and worldwide payment management system is called BlueSnap. This platform enables businesses to accept payments from both local and foreign customers. The best thing about this solution is the way it stops fraud, which leads to a big drop in fraudulent payments. In its Powered Buy Platform, BlueSnap provides a global network of purchasing banks. The benefit is that retailers can make more money by getting the best conversion rates for payments. Another crucial component is BlueSnap’s cutting-edge subscription billing system, which produces precise bills. Other important parts include payment APIs, hosted solutions, payment processors, merchant accounts, virtual terminals, and third-party plugins.

#3. 2CheckOut

A worldwide Payment Gateway Software called 2CheckOut was introduced in 2006. This platform, which is reliable for companies of all sizes, streamlines contemporary digital commerce procedures by making transactions more straightforward for both customers and sellers. It is made to support different payment arrangements and methods on online and mobile platforms. This gateway can handle payments made by consumers using Visa, Discover, MasterCard, JCB, PayPal, or other credit/debit cards. For simpler payments, it can also handle several currencies. The ability of 2CheckOut to interact with a wide range of shopping carts and invoicing programs is another amazing feature. Additionally, it has open API features, so you can easily link it to your current business systems. This platform also meets PCI Level 1 standards, so you can be sure that all of your financial transactions and private information are always safe.

A worldwide Payment Gateway Software called 2CheckOut was introduced in 2006. This platform, which is reliable for companies of all sizes, streamlines contemporary digital commerce procedures by making transactions more straightforward for both customers and sellers. It is made to support different payment arrangements and methods on online and mobile platforms. This gateway can handle payments made by consumers using Visa, Discover, MasterCard, JCB, PayPal, or other credit/debit cards. For simpler payments, it can also handle several currencies. The ability of 2CheckOut to interact with a wide range of shopping carts and invoicing programs is another amazing feature. Additionally, it has open API features, so you can easily link it to your current business systems. This platform also meets PCI Level 1 standards, so you can be sure that all of your financial transactions and private information are always safe.

#4. Stripe

Internet companies may collect payments and handle transactions online thanks to Stripe. It gives online businesses a full set of tools, such as subscription services, on-demand marketplaces, crowdfunding sites, and e-commerce stores. To enable scaling and increase security, the platform leverages a cloud-based architecture. Using the platform to deal with financial institutions, banks, payment networks, regulators, and consumer wallets instead of your company, reduces the complexity of financial operations in online commerce. It offers a solution that marketplaces and payment platforms can use to get payments from and send payments to systems outside of their own. As we’ve already talked about, Stripe can work with any business model because of its simple infrastructure, ready-made UI components, and an API-first approach to customization.

#5. SecurionPay

SecurionPay is next on our list of online and mobile payment options. It is an all-in-one solution made to help businesses with their paid subscription and online payment needs. The software is very flexible and can be used on Mac, Windows, Linux, iOS, and Android. The highly secure payment gateway from SecurionPay has a sophisticated checkout feature that lets customers complete transactions more quickly, increasing conversion rates. The most potent and trustworthy payment gateway software now available on the market was developed by the vendor by combining years of expertise in banking, IT development, and payment processing.

SecurionPay uses well-known anti-fraud methods to check payments for fraud all the time, so security is never a problem. Blacklisting rules, PCI level 1, a 3D Secure tool that doesn’t get in the way, and tokenization are also ways to make transactions safer. It has a native API that enables simple integration with other apps. Additionally, the software provides plugins for popular eCommerce programs like WooCommerce and Magento. Securion Pay offers a clear and straightforward pricing structure of 2.95 percent of the transaction amount plus $0.29. There is also a free trial accessible for people who wish to test the service first.

#6. PayU

Popular Payment Gateway Software PayU provides quick and easy payment procedures for sellers and customers. It synchronizes client purchasing and payment behavior with merchant needs. Additionally, it offers regional experience, a single integration, and cutting-edge technologies for business requirements. More than 250 quick and safe payment options are available with PayU. They work with any computer that can connect to the internet, any e-wallet, any mobile device, and even when you’re not online.

Businesses may customize the solution to match the needs of their local markets in regions including Africa, the Middle East, Latin America, Central and Eastern Europe, and Asia. PayU’s best features are that it works with multiple currencies, tokenization, Web checkout, recurring payments, express payments, and connecting to smartphones. The vendor offers quote-based pricing according to the characteristics your business employs. You may also count on a dependable phone and email help to fix any problems.

#7. PayPal Payments Pro

A payment processing solution built on PayPal’s technology is called PayPal Payments Pro. It can be used by online businesses to process credit card payments as well as retail and mobile credit cards. You can also design and host your own checkout pages for complete control. PayPal Payments Pro offers a fixed rate of 2.90 percent plus a $0.30 per-transaction fee to businesses with high transaction volumes. For credit, debit, reward, and corporate cards, the flat rate stays the same. To use this method, you don’t need a PayPal account. Merchants can also take credit card payments by fax, phone, and mail, as well as online (via Virtual Terminal).

#8. Braintree

Payments are made simpler using Braintree, an online Payment Gateway Software. Tools for international commerce are provided by this program, which may be used to take payments and launch enterprises. Businesses are able to grow globally and build their unique experiences thanks to it. Why is Braintree included in this list of well-known payment processors? For example, businesses in more than 40 different countries use Braintree to authorize and accept payments in more than 130 different currencies. Additionally, because this solution is a member of the PayPal network, consumers have more possibilities for making payments online. Additionally, the company provides straightforward procedures, creative ideas, and top-notch assistance. Some of the standout features include the Braintree vault, dynamic control panel, simple repeat billing, 2-day payment, and global coverage.

#9. Skrill

In a market where there are many subpar money transfer and payment processing businesses, Skrill stands out. With our payment solution, you can help your clients well and not worry about getting paid on time. Skrill was introduced in 2001 and is now a well-known international brand. It is used by a lot of top companies because its features and options are so modern. This company has won several awards, including the EGP B2B Award and the Deloitte Technology Fast 50 Award, for making a great product. One-place data, easy access, credit card transactions, email transactions, and free accounts are some of the key characteristics.

#10. Adyen

For contemporary businesses, Adyen is the perfect payment technology service. This solution, which was created in 2006 by some of the best experts in payment technology, makes it easier to make payments and send money. Adyen can help businesses get new customers because it makes it easy for people to pay online using their phones. With this easy-to-use payment gateway, complicated payment processes may be replaced. Many multinational corporations chose the solution as a result. Some of the best features are recurring payments that can be set up with just one click, remote store management, data driving, and risk management.

#11. Amazon Payments

Both Amazon customers and Amazon merchants may use Amazon Payments. Millions of Amazon customers use it as a quick and dependable payment option. The software comes in two packages: Log In and Pay and Pay with Amazon (merchants) (shoppers). Pay with Amazon enables online merchants to give their consumers a seamless buying experience. It has important features that are meant to attract new customers, turn them into repeat customers, speed up the buying process, and increase customer loyalty through recurring payments and other methods. With login and Pay, Amazon users can quickly check out many apps and websites. This package safely keeps seller information, and apps and websites where you often make purchases can access it.

#12. Authorize.Net

Authorize.Net is a payment gateway solution. It has the right infrastructure and security to transfer transaction data quickly and reliably. This technology routes online transactions just like a regular card swipe machine, so you don’t need to install any software. Authorize.Net is used by over 370,000 retailers to securely take payments. With the help of this technology, organizations can grow their products to meet demand while still being protected from fraud. Using this platform, merchants can quickly manage transactions, change account settings, see account statements, and make reports.

#13. CyberSource

CyberSource offers a wide range of payment management services that make the payment process easier and more efficient. Currently, this technology is used by over 400,000 enterprises for efficient fraud management and safe online payment operations. One of the first payment gateway systems, CyberSource, was established in 1994. By purchasing Authorize.Net in 2007, the business increased its market share. It joined Visa Inc.’s family of companies in 2010. Export compliance, managed risk services, decision management, secure web and mobile acceptance, computation of worldwide taxes, bank transfers and direct debits, payment cards, and cross-channel payments are some of this platform’s key features.

#14. CardinalCommerce

CardinalCommerce is a Payment Gateway Software provider that offers alternative payment brands for both mobile commerce and online commerce. It also enables safe transactions and validated payments. This platform offers payment brands to thousands of international retailers. CardinalCommerce has made the right payment processing solutions for banks and merchants by listening to customers for years and learning from them. More than 180 different currencies and more than 200 different nations use its product line. The key features are hosted payments, digital gift cards, customer authentication, tokenization, mobile marketing, mobile banking, universal wallet, universal PIN debt service, and digital gift cards.

#15. Payza

Payza (which used to be called AlertPay) lets businesses and people send and receive money safely from anywhere in the world. Open a personal Payza account for yourself. For greater requirements, businesses can use business accounts. Similar to other payment gateways, this service carries out standard online payment processing. Payza is used in 190 countries and is offered in 22 different currencies.

The usage of this service by businesses to send and receive money internationally is particularly common in underdeveloped nations. Some of the best things about this solution are that it integrates shopping carts, has centralized management, has payment buttons, offers local payment options, lets you request and send money, and makes online transactions safe.

FAQ

What is a Payment Gateway Software?

Describe it using an example. It is an internet payment system that enables you to take payments from anywhere in the world. For instance, if you book a hotel online through a website called, let’s say, XYZ, XYZ will provide you with a few payment alternatives. Thanks to a Payment Gateway Software service that website XYZ bought, you can pay for things using the options given to you.

How technically does a payment gateway operate?

It functions as a “cashier” for you, collecting money from consumers and depositing it into your bank account. In order to start receiving payments online, your e-commerce site has to be linked with a payment gateway system using APIs.

How do I pick a payment gateway?

Keep the following things in mind while you respond:

- It ought to provide a variety of payment options.

- It shouldn’t take too long to check out.

- Tools for fraud detection should be made available.

- multi-currency payment acceptance

- Recognize transaction costs.

How can I protect my payment gateway?

There are many payment gateway providers that offer security measures to protect the credit card numbers of your customers. This information is usually kept as codes that are encrypted so that no one else can get to it. Always seek a payment gateway that has the highest data security measures.

What is a Stripe payment gateway?

Founded in 2011, Stripe is a well-known supplier of payment gateways. With Stripe, you can connect to more than 450 different platforms, accept payments in 135 different currencies, and be sure that your site will be up 99.9% of the time.

Which online payment gateway is the best?

The top 5 online Payment Gateway Software are PayPal, Authorize.Net, Stripe, 2Checkout, and Adyen. They provide a wealth of useful features that may boost sales by speeding up the checkout process and giving your consumers a variety of payment alternatives in different currencies.