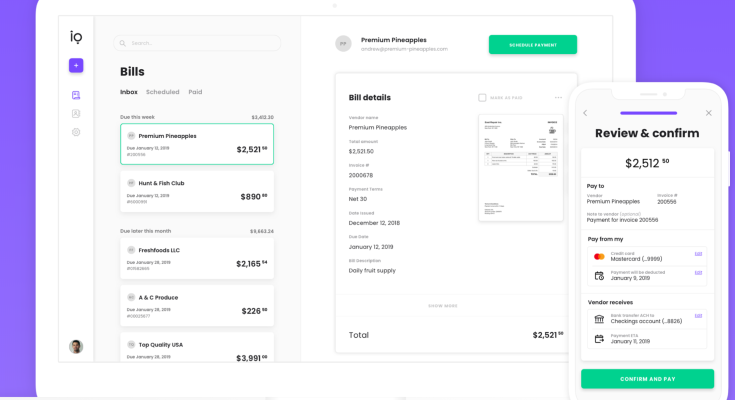

Melio is an online accounts payable service that makes it easy for businesses to pay their vendors with ACH bank transfers, debit cards, and credit cards.

Melio payments sync automatically with QuickBooks, adding payment transactions to a separate app for automatic recording and billing on a schedule. Melio Payments was made so that it would be easy for small business owners to pay and get paid by vendors.

How Does Melio Payments Function?

Melio makes paying vendors simple and easy by allowing small businesses to pay vendors via ACH bank transfer, credit card, or debit card, even if the vendor only accepts checks. It is simple to pay vendors with Melio.

Is Melio safe?

Melio’s website claims that they use cutting-edge cryptographic algorithms when transmitting data and in their databases. Their servers are monitored around the clock, seven days a week, and are housed in PCI and SOC 1, 2, and 3 certified data centres.

Melio’s servers are PCI compliant and do not store any sensitive information. They use a card processor (TabaPay), which is a certified Level 1 PCI Compliant Service Provider and is subject to an annual independent security audit of its processes and systems. The Melio team tests their systems every day, both by hand and automatically, to make sure they are as safe as possible.

Evolve Bank & Trust holds all funds in a secure account until they are delivered to a vendor, so funds are never at risk. What else? All Melio Payments team members go through a thorough review process that includes checking their backgrounds and getting security training.

#1. Recurly

Recurly is a cloud-based billing and invoicing system designed to help businesses streamline billing functions. Recurly integrates with a variety of payment gateways, including PayPal, Stripe, SagePay, and others.

Recurly can also be integrated with existing websites. During the process of setting up Recurly, users can import all of their existing contacts from their old billing software. This lets businesses pick up where they left off before setting up Recurly. It’s a great Melio alternative for online payment.

#2. PaySimple

PaySimple Melio Alternative is the leading payments management solution for service-based businesses, powering the cash flow of over 20,000 businesses across the country. PaySimple forms long-term partnerships with businesses to drive growth by providing flexible payment and billing solutions as well as personalised customer service tailored to their specific business requirements. PaySimple is a trusted technology partner for payment integrations. It has a strong API that handles cash flow natively in SaaS products and mobile apps.

#3. Worldpay

Another best Melio Alternative. Worldpay is a cloud-based online payment processing solution designed for small and medium-sized businesses. Users can collect both in-person and online payments using desktops, smartphones, and tablets.

Worldpay has a virtual terminal interface that lets users collect payments from customers by sharing a secure URL. Customers can use their computers and smartphones to log in and make online and card payments. Worldpay takes many different kinds of payments, like credit cards, mobile wallets, and payment gateways.

#4. MoonClerk

MoonClerk is an online payment processing solution for small and medium-sized businesses that is cloud-based. Within the suite, it provides invoicing, mobile payments, online payments, and recurring billing.

MoonClerk accepts a variety of payment methods, including single payments, recurring payments, subscriptions, and donations. It enables users to create customizable payment options and embed them on business websites. Users can also send payment links to customers via email, SMS, and live chat, as well as request payment from them. It is also a finest Melio alternative.

#5. Bill.com

Another best substitute to Melio. Bill.com is a billing and invoicing-focused cloud accounting solution. Users can use Bill.com to get paid by clients, pay vendors and contractors, and keep track of their finances.

Bill.com includes an accounts payable module in which users can be invoiced electronically or manually enter bills using drag-and-drop functionality. Invoices may then be sent to team members for review. There are several payment options available, including ACH payments and paper checks.

#6. PDCflow

PDCflow Melio competitor enables the secure delivery and capture of payments, e-signatures, and documents via the channels that consumers prefer: payment portals, SMS, and email. Patented Flow Technology enables businesses to connect with their customers via digital channels in order to collect contactless payments and e-signatures and securely deliver documents to the intended party.

PDCflow assists clients in increasing revenue, reducing PCI scope and chargebacks, and improving customer experience. PDCflow is a highly secure digital communication and payment gateway that enables businesses to combine business transactions such as e-signatures, electronic document management, and payments into a single digital workflow.

#7. SecurionPay

SecurionPay Melio alternative is a cloud-based online payment service that enables users to send and receive money. Support for debit and credit cards, as well as recurring billing, are important features.

SecurionPay supports a variety of billing models, such as one-time payments, subscriptions, and mixed billing. The solution includes a single card payment form that allows users to capture billing and shipping addresses from customers. It also has a checkbox for the terms and conditions, can be used in more than one language, and shows a confirmation message when a payment is successful.

#8. Fortis

OmniFund is a PCI-compliant cloud-based online payment processing solution for small and midsize businesses. It provides card payments, invoicing, recurring payments, and reporting capabilities as part of a suite.

OmniFund supports Automated Clearing House (ACH) integration, which lets users connect their cards from different providers like Visa and MasterCard for credit card processing and verification. It is also a best Melio alternative.

#9. LawPay

LawPay is an online payment technology that caters to the legal industry, providing a secure and simple platform for legal professionals to make payments anywhere, at any time. The software makes sure that IOLTA and ABA rules are followed when accepting payments from users.

The app securely connects to the majority of top-tier practice management solutions. It customises payment pages with the law firm’s information. The app is trusted and recommended by more than 50 bar councils, and it is the only trusted payment option offered by the ABA Advantage program.

#10. QuickBooks Payments

Quickbooks Payments is a mobile payment gateway that is best suited for small to medium-sized businesses. The system has software for transactions, a plug-in for a card reader, and a mobile app for processing credit and debit cards right away.

Quickbooks Payments allows users to view a complete transaction history by logging into the website or the mobile application. Users can resend invoices and receipts or cancel charges.

Reports can be viewed in real time and synchronised with QuickBooks automatically. Sales data can also be imported and exported between QuickBooks and GoPayment.

#11. AvidXchange

AvidXchange offers accounts payable software solutions and service teams to help you automate your AP and payment processes. This means that you can replace manual AP with a digital application suite that you can access from anywhere, anytime.

Every aspect of your process, including data entry, approvals, document management, and reporting, is automated by our invoice management solutions. Once approved, invoices are automatically routed to your accounting system for payment processing.

#12. Chargebee

Chargebee is a cloud-based accounting solution for small and medium-sized businesses in industries such as telecommunications and media, e-commerce, and IoT. The solution includes features such as subscription management, invoice management, payment management, and custom report generation.

Users can customise the number of reminder emails sent for failed transactions using Chargebee’s dunning management feature. The solution enables users to translate and localise a webpage’s content as well as configure checkout in multiple languages based on geography. To track dropped checkouts, abandoned cart reports are also available.

#13. IntelliPay

IntelliPay is a cloud-based payment processing solution that assists businesses in the medical, insurance, education, legal, and other industries in managing in-person, online, over-the-phone, and point-of-sale (POS) payments. Sales representatives can include secure payment links in invoices and email them to customers.

Administrators can use IntelliPay to create a white-labeled customer portal where customers can create accounts, pay as guests, or use two-factor authentication. Organizations can use the platform to configure and accept a variety of transaction types, including credit cards, donations, recurring payments, fee-based options, and more. Also, the IVR module has scripts in both English and Spanish that allow merchants to validate credit cards and take payments over the phone while still following PCI DSS rules.

#14. PayJunction

PayJunction is a cloud-based payment processing solution that enables businesses to improve their payment experience for future payments. Users can recharge accounts, process credit card and e-check payments, search and view transactions, enter credit card information, and manage batch transactions. Payments can be processed online or in person. Other key features include secure account storage for credit cards and ACHs, remote signature capture, quick refunds, e-commerce integration, and detailed financial reports.

#15. Bindo POS

Bindo POS is a cloud-based point of sale (POS) system that includes inventory management, customer management, and e-commerce. The solution works with online marketplaces, so customers can buy items right from the store’s stock.

Bindo populates live listing catalogues with a product photo, title, and description by default, and users can then add price and quantity. Their matrix feature classifies products based on up to three attributes, including colour, size, and material.

FAQS

Melio is owned by whom?

Melio was founded in 2018 by CEO Matan Bar, CTO Ilan Atias, and COO Ziv Paz, with headquarters in New York and a research and development centre in Tel Aviv. Melio has also chosen Colorado as its headquarters in the western U.S., and it has already started hiring for 250 new jobs in the state.

Melio’s height?

Melio last raised $110 million at a valuation of $1.3 billion in January. It is regarded as one of Israel’s fastest-growing companies, having nearly quadrupled its value in eight months. The latest investment brings the company’s total fundraising to more than $500 million.