Airbase is a full-service spend management platform that grows with businesses from startups to IPO and beyond. It combines three products into one system: accounts payable, an advanced corporate card program, and employee expense reimbursements. When implemented separately, each product provides all of the core functionality you would expect from a best-of-breed solution. Airbase, when combined, provides a consistent and efficient platform experience for all non-payroll spending. Accounting and approval workflows that are automated provide visibility and control, a faster close, and real-time reporting. It goes beyond budgeting. It’s enlightenment through spending. Visit www.airbase.com to learn more about why innovative companies like Gusto, Segment, Doximity, Getaround, Netlify, and others rely on Airbase. See 24 Best Alternatives To Megashare To Watch Movies – Tendingtech.

Airbase characteristics

- Statistics and Reporting:

- Third-Party Integrations for Reporting and Analytics

- Data Import/Export

- Invoicing and billing

- Workflow Administration

- Audit Trail for Real-Time Reporting

Best Airbase Alternative software for spend management

Here we make a list of the best airbase alternatives & competitors for spend management that grow your business.

#1. Sage 100cloud

Sage100cloud Alternative to Airbase is a cloud-connected ERP platform for medium-sized manufacturers, distributors, and professional service firms. The solution has a lot of features, such as accounting, budgeting and planning, inventory, supply chain, production management, reporting, and customer relationship management (CRM).

Bank feeds and reconciliation detect unrecorded transactions, identify errors and discrepancies, and document corrections automatically. Data from across the organization is aggregated and may be automatically distributed to stakeholders as needed. Click-to-pay invoicing improves cash flow, and a self-service payment portal improves customer service. Mobile access to critical customer and vendor information at any time and from any location means faster deal closures and improved communication across the organization.

#2. Sage 300cloud

Another alternative to Airbase. Sage 300cloud (formerly Sage Accpac) is an enterprise resource planning (ERP) software system made for small and medium-sized businesses in professional services, finance, government, and other markets like distribution and wholesale.

The system helps multinational businesses manage their finances by supporting multiple currencies and locations. Users can manage multiple companies and close books, as well as report results by company or consolidated company.

Users of Sage 300cloud can keep an unlimited number of currencies and exchange rates on file, receive daily updates, and automate the gains or losses from fluctuations. The inventory management features of the system let users ship orders on time from different locations and keep track of inventory by location.

#3. Odoo

Odoo Point of Sale (POS) is a business application that is part of Odoo’s integrated suite. The module can be used online or offline, unifies data across stores, and has a function for managing inventory. Odoo’s POS module is one of many open-source business modules available, including accounting, marketing, warehouse management, and project management. The POS module has features like wireless support, a printer for receipts and labels, a customer history, inventory tracking, and automated ordering.

With the email marketing feature, stores can send customers personalized emails about special deals and sales campaigns. Retailers can also set up rewards and loyalty programmes to provide discounts and other promotional benefits to their loyal customers. It is a great alternative to airbase for the growth of your business.

#4. Dynamics 365 Business Central

Another similar substitute for the airbase. Microsoft Dynamics 365 Business Central is an ERP (enterprise resource planning) software solution for midsize businesses that is based in the cloud and aims to speed up cash flow and streamline operations. This SaaS solution provides specialised functionality for manufacturing, distribution, government, retail, and other industries’ business processes. Before Microsoft bought Navision A/S in 2002, it was made by a company in Denmark called Navision A/S.

Financial management, inventory management, human resource management, quality management, multiple and international sites, project management, sales and marketing, service management, supply chain management, and business intelligence are all available in Microsoft Dynamics 365 Business Central. This ERP solution lets users effectively manage any sales order, set up automated workflows, keep track of all inventory, and see in-depth data analytics.

#5. Centage

Planning Maestro from Centage is a cloud-based planning and analytics platform that gives businesses financial insights all year long. It changes the way businesses budget, predict, and report on performance.

Centage provides sophisticated financial intelligence previously available only to large enterprises at a price point accessible to SMBs. Using this financial intelligence, Planning Maestro synchronises the profit and loss statement, balance sheet, and cash flow to ensure GAAP compliance. This provides users with a long-term view of a company’s financial health rather than just a short-term view.

Planning Maestro also includes 40 pre-built GAAP/IFRS-compliant reports that can be adjusted and customised for a variety of data reporting scenarios. These reports can be sent to Excel or any other local accounting system to be changed further. It is also a finest alternative to airbase.

#6. AccuFund Accounting Suite

AccuFund Airbase alternative is solely dedicated to serving nonprofits and government agencies. The complete fund accounting financial management solution, which is available online or on-site, is made up of a strong core system and modules that allow you to expand as your needs change.

AccuFund’s core system includes accounts payable, cash receipts, general ledger, bank reconciliation, importing and exporting, document storage, a financial report writer, and a form designer for creating customized forms. There are popular add-on modules for accounts receivable, HR and payroll, purchase orders, requisitions, fixed assets, allocations and grants management, and more.

As you continue to serve your community members, you can automate workflow, generate robust reports, customize your dashboards, and improve overall decision-making while enabling transparency and accountability.

#7. Asset4000

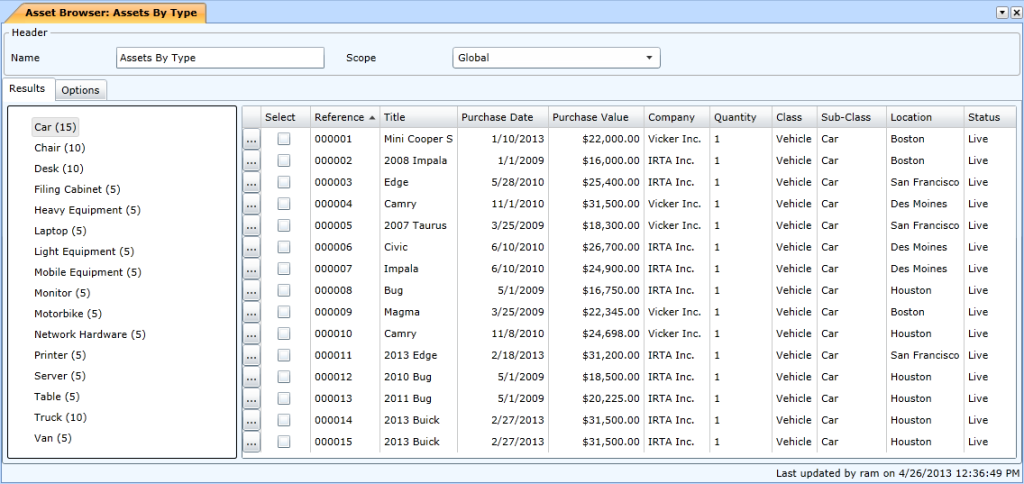

Another replacement to Airbase. Asset4000 is a fixed asset accounting solution for small, medium, and large businesses that is available on-premises and in the cloud. Real Asset Management, the software vendor, has rebranded and is now part of MRI Software, where it will continue to provide the best in specialist fixed asset software. Asset4000 serves the commercial, education, government, healthcare, and non-profit sectors. Asset management, asset accounting, asset auditing, flexible asset depreciation, cost control, reporting, and forecasting are the primary features. Lease management, project management, document management, and tax and financial compliance are among the other features. Users can manage disposals, transfers, relifes, revaluations, cost adjustments, and asset splits using asset accounting features. Asset4000 complies with various corporate governance standards, including US GAAP, SOX, and GASB 34/35. It is compatible with ERP, finance, business intelligence, reporting, and spreadsheet software. It is available as a subscription service. It works with Windows, Mac, and Linux operating systems. Support is available via email, phone, and an online client portal.

#8. Sage Fixed Assets

Sage Fixed Assets provides the most comprehensive fixed asset management solution, with four modules that give businesses complete control over their assets. Sage Fixed Assets handles the whole lifecycle of your fixed assets, from buying them to depreciating them and getting rid of them when they are no longer useful.

Assets flow seamlessly within the Sage Fixed Assets Suite, keeping businesses informed and in a position to make critical decisions that benefit the bottom line. The solution includes integrated accounting features as well as several methods for tracking asset depreciation (bonus depreciation, straight line, ACRS, modified straight line, declining balance). The solution incorporates over 300,000 IRS tax and GAAP rules, as well as more than 50 depreciation methods. Sage Fixed Assets is ideal for businesses of all sizes, industries, and verticals. It is available for both on-premise and cloud deployment.

#9. Planful

Planful is the pioneer of cloud software for end-to-end financial close, consolidation, and financial planning and analysis (FP&A). Globally, the Planful platform is used by the Office of the CFO to streamline business-wide planning, budgeting, consolidations, reporting, and visual analytics. Planful is trusted by over 1,000 customers, including the Boston Red Sox, Del Monte, TGI Friday’s, and 23andMe, to accelerate cycle times, increase productivity, and improve accuracy across the entire FP&A process. Planful has been invested in by Vector Capital, a leading global private equity firm.

#10. Bloomberg Tax

Bloomberg Tax & Accounting Services Fixed Assets software is a cloud-based solution that assists businesses in managing their fixed assets throughout their entire lifecycle, from construction and purchase to retirement. Key features include fixed asset management, inventory management, and compliance. Processes are automated, and compliance with constantly changing tax and GAAP regulations is ensured. Management is made easier, and full reports give managers the information they need to make good decisions.

#11. Xero

Xero is a cloud-based accounting system for small and growing businesses. Xero connects small businesses with trusted advisors and gives owners instant visibility into their financial position. Xero can be accessed from any device with an active internet connection because it is a web-based solution. Small businesses can view their cash flows, transactions, and account details from any location thanks to Xero’s robust accounting features. All bank transactions are imported and coded automatically. Online bill pay assists in keeping track of spending and staying on top of bills due, while also improving relationships with vendors who supply critical business materials. Personal expenses can also be managed with Xero via mobile review and approval of each receipt. Xero provides unlimited user support as well as integration with a wide range of systems, including ADP, Bill.com, and Vend. For product testing and feature evaluation, the solution includes a 30-day free trial period.

#12. AccountingWare’s

AccountingWare’s ActivityHD is a fully integrated accounting system designed to provide flexibility and improve decision-making. Businesses can use ActivityHD to manage complex systems efficiently within a centralised system. ActivityHD offers customizable tools that are unique to your company, without the constraints that other solutions may have. ActivityHD’s core accounting and payroll modules are ActivAP (accounts payable), ActivAR (accounts receivable), ActivBR (bank reconciliation), ActivFA (fixed assets), ActivGL (general ledger), and ActivPR.

Businesses can use the ActivAP module to track expenses, manage all invoices, and schedule payments while maintaining direct data visibility and control. For efficient billing, ActivAR offers invoice tracking as well as a detailed receipt processing operation. ActiveBR’s module lets businesses reconcile an unlimited number of transactions at once. It shows all checks, voided forms, and bank statements in a single format.

#13. Vena

Vena is a full-service planning platform that incorporates the familiarity and flexibility of an Excel interface into the Vena Growth Engine. Its technology and methodology power the growth of over 950 businesses worldwide. Vena provides enterprise-level scalability, performance, and extensibility while remaining user-friendly. Vena unifies your people, departments, processes, and systems into a single source of truth and automates tedious tasks, giving you more time to focus on future planning. Vena’s workflow builders and integrations keep teams up to date and on track with the most recent actuals. In addition, Vena can also assist in the discovery of efficiencies as well as the maintenance of data integrity and security in order to improve overall business performance.

#14. Traverse

Open Systems, Inc. has been developing cost-effective and modular solutions for business accounting and enterprise resource planning for nearly four decades. They created TRAVERSE to provide businesses with the perspective they need to make informed decisions and drive revenue. TRAVERSE is easy to set up because it works with most existing databases and can be deployed either on the web or on-premise.

With TRAVERSE’s extensive suite of applications, you can streamline operations, cut costs, and integrate data. Standalone applications are available for Core Accounting (including support for multiple currencies and languages), Project Accounting, Fixed Asset Accounting, and Payroll. Comprehensive applications for Fund Accounting, Inventory Management, Billing and Invoicing, Work Order Management, Budgeting and Forecasting, Financial Reporting, and Purchasing are included in the suite. TRAVERSE works on most mobile and web devices and lets you connect to orders, expenses, and warehouses in real time.

#15. Rydoo

Rydoo is an expense management solution that assists high-growth and enterprise businesses in reducing administrative work and easily processing employee expenses. It lets users scan and digitize receipts using the Rydoo Expense mobile app to scan receipts and get the data from them.

Rydoo enables employees to submit corporate expenses such as client dinners, taxi rides, and flight details for approval. Also, the unified dashboard lets administrators get actionable information about trip costs and make reports to keep track of what travelers are doing.

Some of the third-party apps that Rydoo works with are SAP, Slack, Uber, Oracle, Netsuite, Quickbooks, and Sage. Pricing is based on monthly subscriptions, and support is available via email and chat.

FAQS

What exactly does Airbase do?

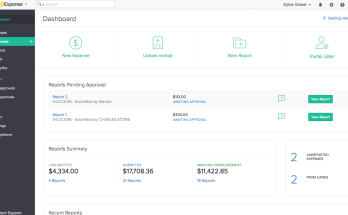

Airbase is the first all-in-one cloud-based spend management software that gives businesses complete control over every dollar spent. One platform handles expense requests, approvals, bill payments, accounting automation, and real-time reporting. Schedule your demonstration.

Is there a mobile app for Airbase?

Administrators and managers can use the Airbase app for iOS or Android to track real-time spending and balances for physical cards.

Is the base a good place to work?

Is Airbase a good place to work? Airbase has a 4.9 out of 5-star rating based on over 45 anonymous employee reviews. 99% of employees would recommend working at Airbase to a friend, and 99% are optimistic about the company’s future. This rating has risen by 2% in the last year.